Blog read time : 2 mins

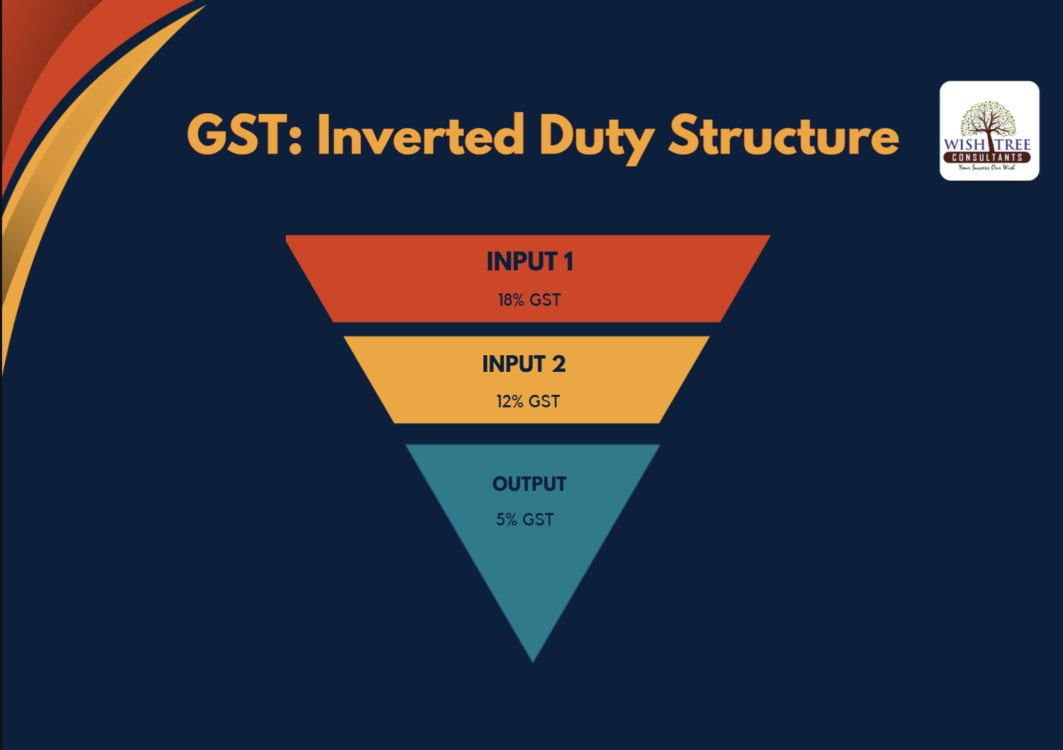

Hey guys! India’s GST system-la oru periya issue na Inverted Duty Structure. Simple-a sollanum na, raw materials-ku high GST rate, but finished goods-ku low GST rate. Ithu naala manufacturers-ku unutilized Input Tax Credit (ITC) accumulate aagudhu, which creates cash flow problems.

Example to Understand

Oru example eduthu paaklaam. Textile industry-la, inputs (raw materials)-ku GST 12% to 18% varaikkum irukum. Aana finished goods-ku GST 5% dhan! Ithu nala manufacturers ku GST burden adhigama aagudhu, plus pricing strategies kooda complicate aagudhu. End result? Costs consumers-ku kooda adigama varalam!

Impact on Businesses

Ithu working capital-a romba affect pannudhu. ITC unutilized-a irukkuthu ,athunala, operational needs-ku funds kedaikkama poidudhu. Though GST law refunds allow panradhu, refund process cumbersome-a irukudhu, and compliance challenges varudhu.

What’s the Solution?

Ithukaga GST Council reforms discuss panniranga. Refund process simplify panna and financial strain reduce panna oru plan iruku. Ithu manufacturers-ku liquidity improve pannum, and economy stable-a iruka help pannum.

Stay tuned for updates on GST reforms and how they impact businesses! 💡